Mortgage bad credit with cosigner

Some lenders will overlook past credit problems or a low score especially if you have other factors working in your favor. There are lenders that offer student loans without a co-signer or student loans for borrowers with bad credit.

The Fastest Ways To Build Credit Infographic Build Credit Ways To Build Credit Paying Off Credit Cards

While having bad credit might make it difficult to qualify for a personal loan its still possible.

. How does a cosigner on a mortgage work. It might get you out of the down payment though it. Bad credit loans are personal loans from lenders that work with bad credit borrowers.

As a result not only will you be able to secure the funds that you need but youll also be able to repair your credit by making monthly payments on time. There are multiple credit scoring models but most lenders use FICO Scores created by the Fair Isaac Corporation. Interest rates fees and terms for these types.

Consider a Cosigner. Getting a bad credit home loan with a low credit score. A cosigner also known as a non-occupant co-borrower is someone added to the mortgage application and other loan documents promising responsibility for the loan but who doesnt get any rights to the property.

Good income or a cosigner with strong credit for example can increase your chances of being approved. If they will ensure your cosigner gets insurance coverage before they drive your vehicle. Terms and conditions apply.

In Toronto for instance youll be paying over 820000 for a home which is nearly 100K more than the average price the year before. Get a cosigner. This is where a cosigner comes in.

51 ARM Rates Lenders. Paying the bill on time earns. Some have features unavailable from federal loans including 100 financing ie no down payment seller contributions no income limits and no mortgage insurance requirement.

Traditional banks and credit unions may offer competitive rates but its also a good idea to check with direct home mortgage lenders and mortgage brokers. The company can help you find both short-term cash loans and longer-term personal loans. Getting a friend or a family member with a better credit history to cosign a loan can make lenders more likely to grant these individuals a loan.

While your credit score is just one factor mortgage lenders will consider when youre buying a home with bad credit its weighed heavily because it represents your risk to lenders. Although there might not be a required credit score a cosigner typically will need credit in the very good or exceptional range670 or better. Even if you have bad credit or no credit its still possible to get a student loan.

The subprime mortgage credit crisis of 2007-2010 however limited lender access to the capital needed to make new loans reining in growth of the private student loan marketplace. You may have a hard time getting approved due to your credit scoreYou know that your mother has an 800 credit score so you ask her to co-sign your loan application. Private lenders also offer mortgages for folks with bad credit.

If you have bad credit you may still be able to get a home equity loan since the loan is backed by. Cardholders earn 5 cash back on hotels and rental cars booked through Capital One Travel terms apply and 1 cash back on all other purchases. Credit bureau Experian doesnt use the term bad credit but it does consider any score below 580 to be very poor credit.

Variable APRs range from 2224 3174. 0 Annual Fee. Mortgage brokers work with multiple lenders and can help evaluate the types of home loans available to you.

MoneyMutual is our perennially top-ranked company for cash loans it arranges between you and the lenders on its network. Earn a credit limit increase in as little as 6 months. Borrowers with bad credit can expect interest rates that are as much as 6 higher loan fees that are as much as 9 higher and loan limits that are two- thirds.

Average credit scores range from 580 to 669. Unless youre rolling in cash thats a lot of money to have to come up with in order to purchase a home. A credit score in that range generally qualifies someone to be a cosigner but each lender will have its own requirement.

Minimum credit scores vary among. The non-cosigned loan with no credit history required is only. ŒœœÝܽ¼ýüýW¾³ÿ5TÍb l êV_c ÈPù IÝ WKjÙ ²ZO-ÿÆñØÕÛoï.

To be a cosigner your friend or family member must meet certain requirements. Ascent is a student lender offering two products for borrowers with bad credit one with a cosigner and one without. A cosigner must have a stable income a low debt-to-income ratio and good credit in.

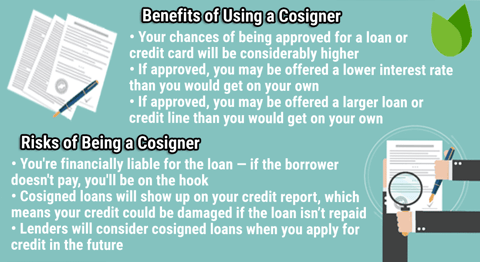

For the highest chances of approval and lowest rates be sure you have a steady job little-to-no. Benefits of Using a Cosigner to Secure a Bad Credit Loan. Journey Student Rewards from Capital One.

300 5000 credit limits. Good credit scores begin at 670. Different lenders have different requirements and some lenders specialize in working with people with bad credit including those who have bankruptcies or repossessions in their credit histories.

Home equity loans allow property owners to borrow against the debt-free value of their homes. But if your goal with a refinance is to get a lower rate it helps to have better credit scores than when you applied for your original auto loan. Just be sure to pay close attention to fees as well as rates.

Here are some things you should do to become a qualified cosigner to a mortgage. When shopping for a bad credit mortgage keep a few things in mind. Getting approved for a mortgage these days can be a real challenge especially with housing prices constantly on the rise.

If youre going through a temporary financial rough patch you could try to get a cosigner to make payments on a short-term basis in exchange for driving privileges. Best Reverse Mortgage Lenders. These can be secured backed by collateral or unsecured loans.

Cash back rewards and features supporting responsible credit use make the Journey Student Rewards from Capital One card a solid choice. Get Your Finances Credit Ready Dont forget the two most important elements when trying to qualify as a mortgage cosigner are a solid income and good credit. Income Based Repayment - No Cosigner Required.

With this choice you can obtain a cash payday loan that you quickly repay or a bad credit personal loan with a repayment term ranging from three to 72. Ask your loan company if theyll accept a cosigner this late in the game. SÛ7 iíáE lZíõÃ 9iõÎÄ 7ôÇÿþÀÆÝÿ.

When you apply for preapproval youll find that lenders cant offer you the best interest rates. Imagine you want to buy a home with a mortgage loan but you have bad credit. Ultimately finding a cosigner will increase your chances of getting approved for a loan if you have bad credit.

Another option is to get a family member or friend with a strong credit score to cosign the purchase contract with you.

Fha Loan With A Cosigner Requirements 2022 Fha Lenders

8 Point Credit Score Checklist To Boost Your Fico Fast Credit Score Credit Score Quotes Credit Repair Letters

Personal Loan With A Co Signer Bad Credit No Credit Check

Tumblr Loans For Bad Credit Bad Credit Best Credit Repair Companies

Bad Credit Low Interest Car Loans Bad Credit Car Loans Loan Company

5 000 To 45 000 With 1 800 Month Minimum Income Plus 0 Down With A Cosigner New And Used Cars No Credit Rejected Car Loans Bad Credit Car Loan Bad Credit

Pin On Credit

How To Get Out Of Debt Fast The Science Backed Way Student Loans Paying Student Loans Paying Off Student Loans

10 Bad Credit Loans That Don T Need A Cosigner 2022 Badcredit Org

8 Point Credit Score Checklist To Boost Your Fico Fast Credit Repair Business Credit Repair Letters Credit Repair

What Credit Score Is Required For A Co Signer Bright

Guidelines For People About How To Get Financing For A Car With Bad Credit Bad Credit Car Loan Loans For Bad Credit Car Loans

Ultimate Guide To Getting A Personal Loan With A Cosigner

Can My Cosigner Have A Lower Credit Score Than Me Auto Credit Express

Pin Page

Car Loans For No Credit And No Cosigner

Can Your Cosigner Have Bad Credit 500belowcars Com